- Startseite -

- Digital Bavaria -

- Blog #bytevaria - “Computers on wheels”: How the Bavarian automotive and semiconductor industries are changing the future of mobility.

“Computers on wheels”: How the Bavarian automotive and semiconductor industries are changing the future of mobility.

In a 2020 study, leading consulting firm Roland Berger called the cars of the future “computers on wheels.“ It is fair to say that in most instances this is already the case today. Consequently, processors are increasingly becoming the heart of the car, making electronic hardware and application software the differentiating factor.

As a worldwide leading automotive hub, Bavarian manufacturers and OEMs have long recognised the need for electronic processing power and have been establishing strong relationships with the semiconductor and microelectronics industry over the past decades. But electrification, digitalisation, connectivity, and autonomous driving will further increase demand for electronic parts. Along with the effort to create more resilient supply chains, this creates future business opportunities for semiconductor companies in Bavaria, notably in chip design.

To satisfy rising demand and gain a competitive advantage, new types of cross-industry partnerships are emerging.

Centre of attraction – why Bavaria's world-renowned automotive hub is also a key playing field for the semiconductor and microelectronics industry

Bavaria is recognised as the worldwide automotive centre of the past, present and future with brands such as Audi and BMW headquartered here. What’s more, Bavaria-based OEMs count among the most innovative automotive manufacturers in the world in electromobility, networked vehicles, and autonomous driving. Four of the 10 companies and institutions with the most patent applications in 2021 came from automotive industries in Bavaria.

Likewise, the semiconductor industry has always thrived in the region.

MUNICH is home, for example, to the headquarters of Infineon Technologies AG, Germany's largest semiconductor manufacturer which also competes at the top international level.

“We make cars clean, safe and smart.” Infineon can feel confident making this promise to the automotive sector, as it can look back on 40 years of success and proven expertise in supplying high-quality semiconductors for electronic systems. Today, Infineon’s sensors, microcontrollers, and power semiconductors help car manufacturers worldwide achieve safety, affordability, and efficiency targets which grow more challenging every year.

In addition to Infineon, many research and development branches of international companies can be found in Munich. These include industry giants such as Nvidia, AMD, Apple, Samsung, arm, and Intel. But other well-known semiconductor manufacturers have also set up shop in Munich with a focus on research and development. These include NXP, STMicroelectronics, Micron, Qualcomm, Bosch Sensortec, Analog Devices, and Renesas. The proximity to the automotive industry is a key motivation for companies to locate here.

In FREISING, Texas Instruments has been conducting semiconductor research, development, and production since 1966. The production facility was upgraded to 200 mm wafers in 2000 and now has around 10,000 square metres (ca. 110,000 sq. ft) of clean room space. Freising is also the site of a variety of R&D activities related to chip design, production efficiency, and sustainability.

Texas Instruments works closely with the automotive industry to facilitate innovation and pave the way for a wide variety of automotive design challenges, from electrification to drive-assist technologies.

In REGENSBURG, ams OSRAM produces semiconductor products in a plant run by Infineon. As a leading provider of optical solutions in the automotive segment, ams OSRAM covers the entire product range from visible to invisible light and sensing applications.

NUREMBERG is the location of a leading global technology manufacturer in power electronics: Semikron Danfoss. This family-owned business profits from its long-standing relationships with the automotive sector which have given it deep expertise and experience in electric vehicle powertrains. As early as the late 1990s, SEMIKRON was already producing inverter drives for the first-ever hybrid electric vehicles. It is also active in the area of industrial and light electric vehicles (such as forklifts and motorcycles) as well as trucks, buses, heavy-duty utility vehicles, and electric car charging stations.

On top of that, there are a wide variety of companies from all over Bavaria representing other parts of the value chain, such as the wafer manufacturers SiCrys-tal in Nuremberg, Siltronic in Munich, or the semiconductor equipment supplier SÜSS MicroTec in Garching near Munich.

These and many other partners are members of the Bavarian Chips Alliance. In autumn 2021, Minister of Economics Hubert Aiwanger launched the Bavarian semiconductor network to promote the industry and the region as a business location by making supply chains more resilient and driving innovation, notably in the automotive sector.

Accelerating collaboration – how the automotive and semiconductor sectors in Bavaria are combining forces to build a resilient future with a competitive edge

Changing technological requirements, the need for a competitive edge and continuous innovation require even closer relationships between the automotive and semiconductor industries. In addition, the pandemic brought supply bottlenecks, showing the necessity of nearshoring initiatives to make supply chains more resilient, crucial for reducing dependencies on overseas sourcing.

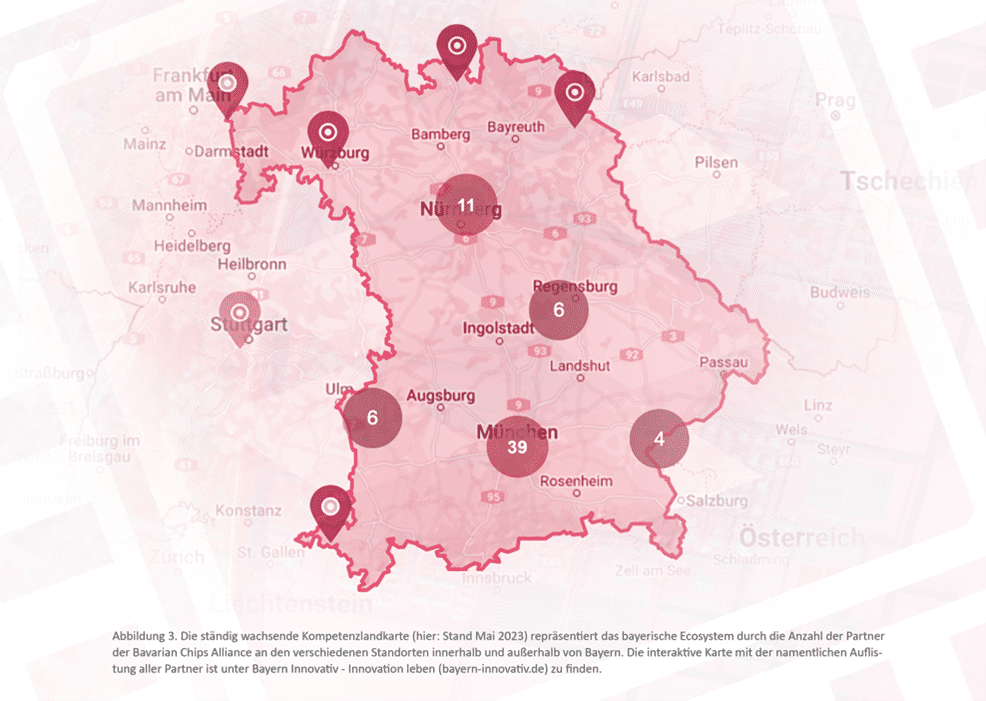

Figure 3. The constantly growing competence map (here: as of May 2023) represents the Bavarian ecosystem by the number of partners of the Bavarian Chips Alliance at the various locations inside and outside Bavaria. The interactive map listing all partners by name can be found at Bayern Innovativ.

This has resulted in new types of collaborations and relationships that present opportunities for partners on both sides.

For example, in 2021 BMW forged a direct agreement with the leading semiconductor firms Inova Semiconductors and GlobalFoundries. It involves a total of several million microchips per year, which in this case are needed for the smart LED technology ISELED. Such deals are unusual for the automotive industry where carmakers usually only conclude arrangements with suppliers of complete components. This direct contract with chip and semiconductor producers affords both sides more planning security.

A great example for building a competitive edge is Audi’s collaboration with Texas Instruments on its trailblazing digital light technology. The secret behind the digital matrix LED headlights is a so-called DMD chip (Digital Micromirror Device) from Texas Instruments. The U.S. company installs no less than 1.3 million tiny mirrors in the chip, which is barely larger than a thumbnail. An electrostatic field makes it possible to control each of them individually and tilt them by 12 degrees - up to 5,000 times per second.

A focus on chip design – how partnerships in this key element of the value chain are a vital success factor for the future

In the future, the automotive industry will focus increasingly on chip design, which is why this part of the value chain has also been at the centre of attention of the Bavarian Chips Alliance.

Bavaria’s Minister of Economics Hubert Aiwanger comments: “Most of the know-how and a considerable part of the value chain is in chip design. This is why Bavaria will have its own Bavarian design centre under the direction of the Fraunhofer Institute. Whoever designs and develops the semiconductors of the future will have worldwide influence. Of course, this also means great economic potential.”

In this spirit, American semiconductor champion Wolfspeed and leading automotive OEM ZF are building a new chip design centre near Nuremberg. Semiconductors made of silicon carbide are being developed and further enhanced there for the automotive industry, other vehicle manufacturers, and green energy plants.

In fact, developing their own chips with so called “fabless” companies is a key strategy for many automotive manufacturers.

For example, ADTechnology opened its first international branch in Unterschleissheim near Munich with support from Invest in Bavaria. In its home country of South Korea, the company is best known as the largest design solution partner of Samsung Foundry and was an earlier partner of the Taiwan Semiconductor Manufacturing Company (TSMC).

Hong-Young Lee, General Manager ADTechnology Europe GmbH, says:

“Automotive is a ‘super-segment’ for ADTechnology, as the twin challenges of electrification and regulation together with driver assistance and the self-driving revolution bring numerous lidar, radar and video sensor companies to the market. The established OEM and tier-1 relationships in the automobile market may never be the same again.”

In the context of chip design, a fabless company is a semiconductor company that focuses on the design and development of integrated circuits (ICs) or chips, but outsources the actual manufacturing of these chips to specialised manufacturing facilities called foundries.

Likewise, James E. Mister, Invest in Bavaria’s San Francisco-based representative, notes: “Many chip design firms are attracted to Germany and Bavaria in particular, not simply because of applications across telecom and edge devices, data centres, and now Gen AI, but (mainly) by the automotive-mobility-autonomous driving R&D ecosystem.”

Another trend emerging in the automotive sector is the adoption of RISC-V. RISC-V (pronounced "risk-five") is an open-source instruction set architecture (ISA) that allows anyone to design and implement their own processors based on the RISC-V specifications.

The adoption of RISC-V in the automotive sector offers potential benefits such as customization, cost savings, and innovation, but it also comes with challenges related to ecosystem maturity, certification, interoperability, and IP protection.

As these challenges are being addressed, the way automotive companies and their technology partners work together to build increasingly software-defined vehicles will be evolving. However, all players agree: collaborations and partnerships will play a crucial role in driving growth. In Bavaria, cross-industry innovation between the automotive sector and the semiconductor industry presents a big opportunity on both sides, today and in the future.

Invest in Bavaria can guide you in exploring potential cross-industry innovation offers in the automotive sector. Our services are free, confidential, and customised to your needs. Talk to us first!

- If there’s a suitable site for your project, we will know about it

- We can connect you with the right people

- We can give you an overview of possible options for funding and support

- We can provide you with an overview of the market.

And by the way: if you want to learn more about Bavaria as a business location and how Invest in Bavaria can help, click here to meet our success ambassadors and hear what they have to say.

The technologies that companies should invest in over the course of 2024

How a passion can transform into a successful business

![[Translate to English:] [Translate to English:]](https://ik.imagekit.io/sgliwi1izsz/_processed_/d/d/csm_Invest_In_Bavaria3924_149fc14d1d.jpg?tr=w-1024 1024w, https://ik.imagekit.io/sgliwi1izsz/_processed_/d/d/csm_Invest_In_Bavaria3924_149fc14d1d.jpg?tr=w-1280 1280w, https://ik.imagekit.io/sgliwi1izsz/_processed_/d/d/csm_Invest_In_Bavaria3924_149fc14d1d.jpg?tr=w-1536 1536w, https://ik.imagekit.io/sgliwi1izsz/_processed_/d/d/csm_Invest_In_Bavaria3924_149fc14d1d.jpg?tr=w-1920 1920w)